- 2013 EUC Update for PA unemployment Benefits

- What to do when you are unable to get through to the PA unemployemnt Office

- How to Find a PA careerlink Unemployment Service Locations

- How to Check your PA Unemployment Claim Status

- How to Stop Unemployment Benefits in Pennsylvania

- Erie PA UNEMPLOYMENT OFFICE

- Reading, PA Unemployment Office

- Scranton, PA Unemployment Office

- What PA Workforce Can Do For You

- Pennsylvania Unemployment Benefits: What Is PREP And Why Must I Attend

All workers who filed for unemployment benefits after January, 2012, must meet the new Pennsylvania unemployment compensation benefits requirements. If you are new to unemployment benefits or you are used to the previous requirements, you could be in for a nasty surprise. Avoid denials of benefits by understanding what the new requirements are and what you need to do to meet them.

There are three main requirements to qualify for UC benefits in Pennsylvania. Notice these are requirements for workers who already have met the financial criteria for unemployment compensation.

1) You must register with the Pennsylvania Career Link website. Click her to visit the website you must use to register. Once you are at the PA Career Link website click on “new user” and select “individual seeking services”. Follow the instructions and create your personal Keystone ID and password. If you already have a keystone ID and password, login and go to your homepage. Click on “base record” and select “edit”. Ensure your profile has your social security number and update all other relevant information.

2) Carry out an active search for work after the second consecutive week you are unemployed.

3) Keep a record of your work search. The PA Department of Labor may request to see this record at any time.

Most of the changes in the new Pennsylvania Unemployment Compensation requirements are focused on the definition of “active search”. As far as the Pennsylvania Department of Labor is concerned there are two conditions workers must satisfy to meet the “active search” requirement. The first condition involves workers who have been three to eight consecutive weeks unemployed during their benefit year. These workers must apply to at least two positions a week but are allowed to restrict their job search to positions that offer similar wages and benefits to their previous employment and are within a 45 minute commute. In addition to this workers must also search work by using alternative methods such as attending a job fair, searching online at the Pennsylvania CareerLink system, take a civil service test or use the services of an employment agency.

The second condition applies to workers who have been nine or more consecutive weeks unemployed. According to the new rules these long-term unemployed workers must increase their job search efforts and apply to a minimum of three positions a week and widen their scope to include any suitable work they are capable to perform in order to meet their required number of job requirements during the week.

The Department of Labor and Industry of Pennsylvania has created a new Shared Work Program to help employers keep their skilled workers and avoid lay-offs. Find out if your company or your employer qualify for this program. The shared work program could mean the difference between a reduced work schedule or unemployment or between losing a skilled worker and keeping a valuable member of your team.

The changes to the new Shared-Work program start to apply in March 2012. These changes affect the requirements a worker and a company must meet to qualify. These changes are hot from the press so stay with us and see how Pennsylvania can help protect your jobs and strengthen your company.

The Basics

First let’s review what a shared-work program is. A shared-work program is a government subsidy that allows employers to temporarily reduce the work hours of their workers and tops up the difference to the worker’s wage by granting eligible workers a percentage of their unemployment compensation weekly benefit amount.

Reduction Percentage

A key factor when calculating eligibility for the shared-work program and the benefits workers will receive is the employee’s ‘reduction percentage’. The reduction percentage of a worker is percentage of work hours eligible workers see their hours reduced by. For example, if you usually work 40 hours a week and your employer reduces your week work hours to 32, that is a 20 percent. A 40 percent reduction would mean you are left with only 24 hours of work when you started with 40 hours. It is important for workers to understand that to qualify for the shared-work program all workers in the program must suffer the same reduction percentage. You cannot pick and choose how many hours each worker’s work schedule will be reduced by. To qualify, the reduction percentage of the workers in a company must be greater than 20 percent but lower than 40 percent.

Top-Up

The amount a worker will see his reduced wage topped-up by will depend on her weekly benefit amount at that time. The weekly benefit amount of a worker is the amount of weekly benefits she would be eligible for if she applied for unemployment benefits. The Department of Labor and Industry will provide workers in the shared-work program with the same proportion of their weekly benefits amount as their reduction percentage. For instance, if a workers hours are reduced by 30 percent he will be eligible for up to 30 percent of her weekly benefit amount.

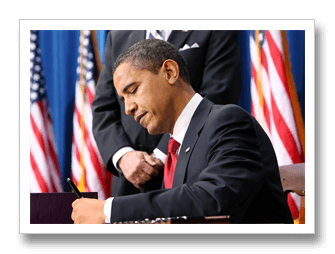

On February 22, 2012, President Obama signed the “Middle Class Tax Relief and Job Creation Act of 2012”. Among other things, this act provides Pennsylvania unemployed workers with funding for the Extended Benefits up until December 31, 2012. Unfortunately for long term unemployed workers this does not mean Extended Benefits payments will continue until that date. Unemployment rate forecasts predict the unemployment rate in Pennsylvania will fall below the trigger level for Extended Benefits towards the end of April 2012 and stop altogether by the middle of May, 2012.

The May trigger off date applies to regular Extended Benefits payments. If you are on High Unemployment Period Extended Benefits payments, you may have already received your last unemployment benefits check. Confused? Don’t worry, you’re not alone. This article will review the implications of the “Middle Class Tax Relief and Job Creation Act of 2012” and the effects of relatively low unemployment in Pennsylvania on the maximum number of benefits weeks unemployed workers are eligible for.

Regular Extended Benefits

The regular extended benefits will trigger off in April 2012, if the employment market continues to improve as predicted. This means long term unemployed workers may receive their last check on the week ending on May 12, 2012. This will ultimately depend on the Pennsylvania unemployment rate and how it compares with the unemployment rate of the same period in the last few years. The maximum number of weeks in this week for eligible workers is 13 weeks.

State High Unemployment Period Extended Benefits

Due to the especially high unemployment rate during the recession years, the government authorized an extension of extended benefits for states with high unemployment rates of 7 weeks. The recovery Pennsylvania has seen during the last year means Pennsylvania workers are no longer eligible for high unemployment period, or HUP, extended benefits. The end of these benefits occurred on the week ending on February 18, 2012. This also includes workers who were receiving these benefits and still had weeks of high unemployment period benefits remaining on their claim.

Federal Emergency Unemployment Compensation, or EUC

The EUC benefits will continue until the end of 2012 just as long Pennsylvania’s total unemployment rate, or TUR, does not fall below the trigger off rate. As of now, the total unemployment rate of Pennsylvania is not known. As of now, it is likely that Pennsylvania will qualify for EUC tiers 1 to 3, which only require an unemployment rate of 7 percent or higher. Tiers 1,2 and 3 provides unemployed workers with a maximum of 47 weeks. However if the unemployment rate drops below 7 percent, workers will only qualify for tiers 1 and 2, which provide a maximum of 34 weeks.